crypto tax calculator uk

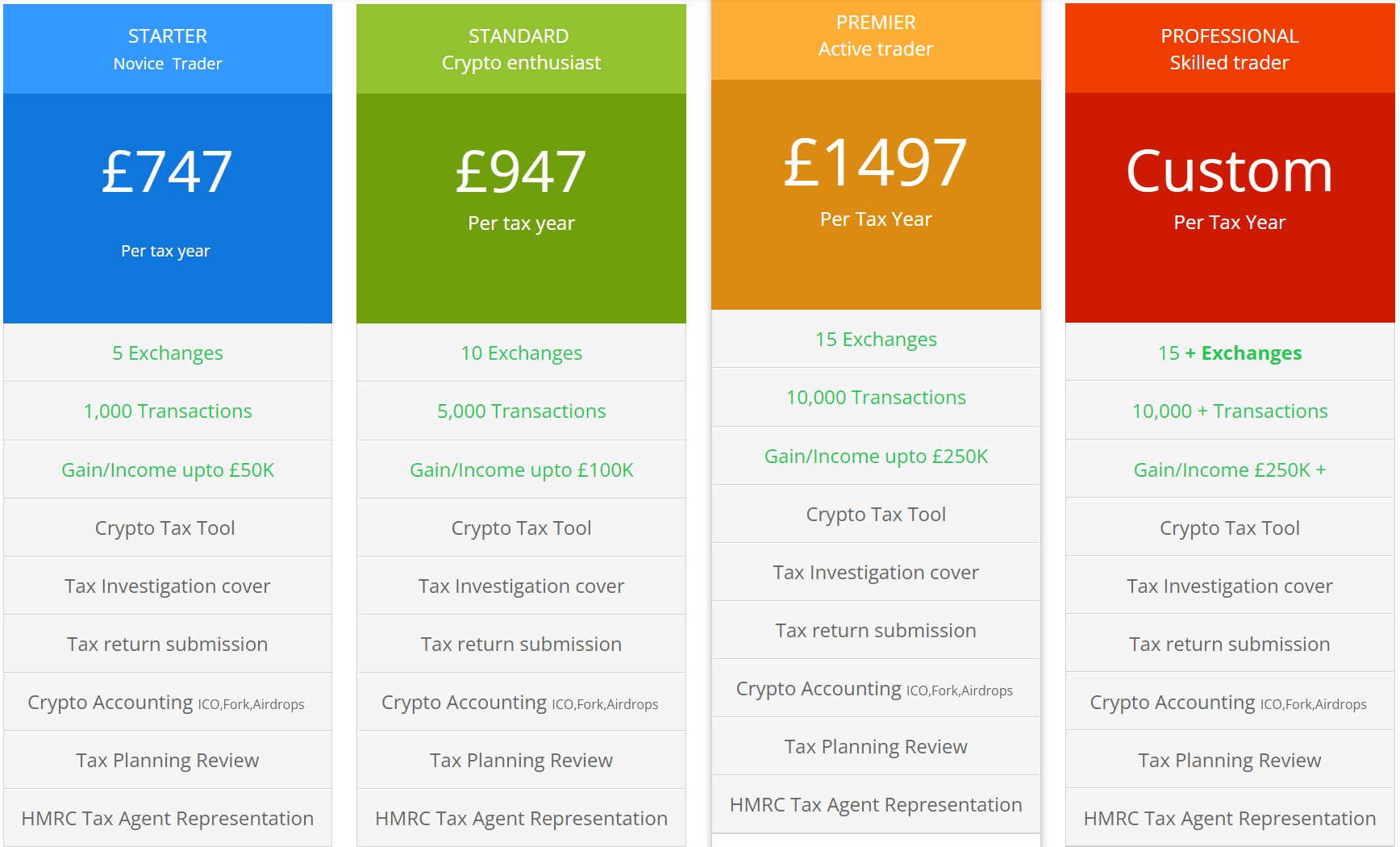

Plans Pricing All plans. Your tax authority wants to know your equivalent profits or losses in the.

Uk Tax Rates For Crypto Bitcoin 2022 Koinly

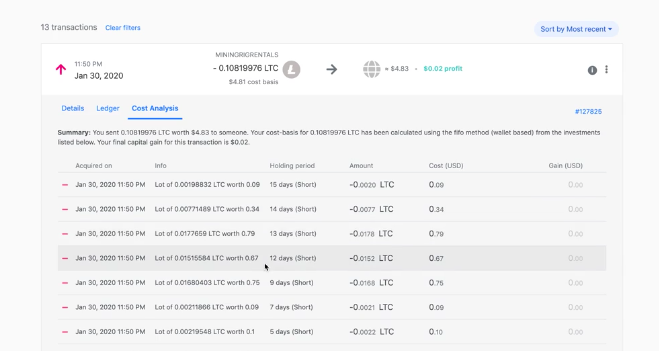

The HMRC uses an average cost basis to calculate the cost on capital gains.

. It helps you calculate your capital gains using Share Pooling in accordance. To calculate tax on crypto-to-crypto transactions you have to calculate the value of each crypto in fiat. Most UK crypto investors live in London.

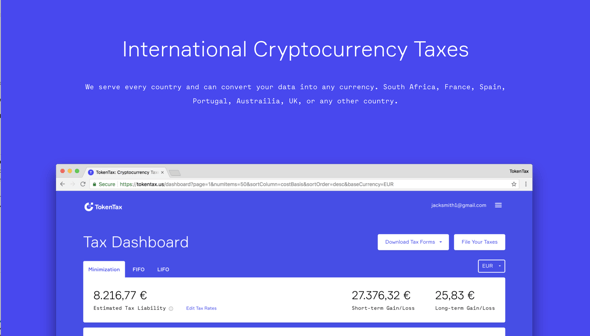

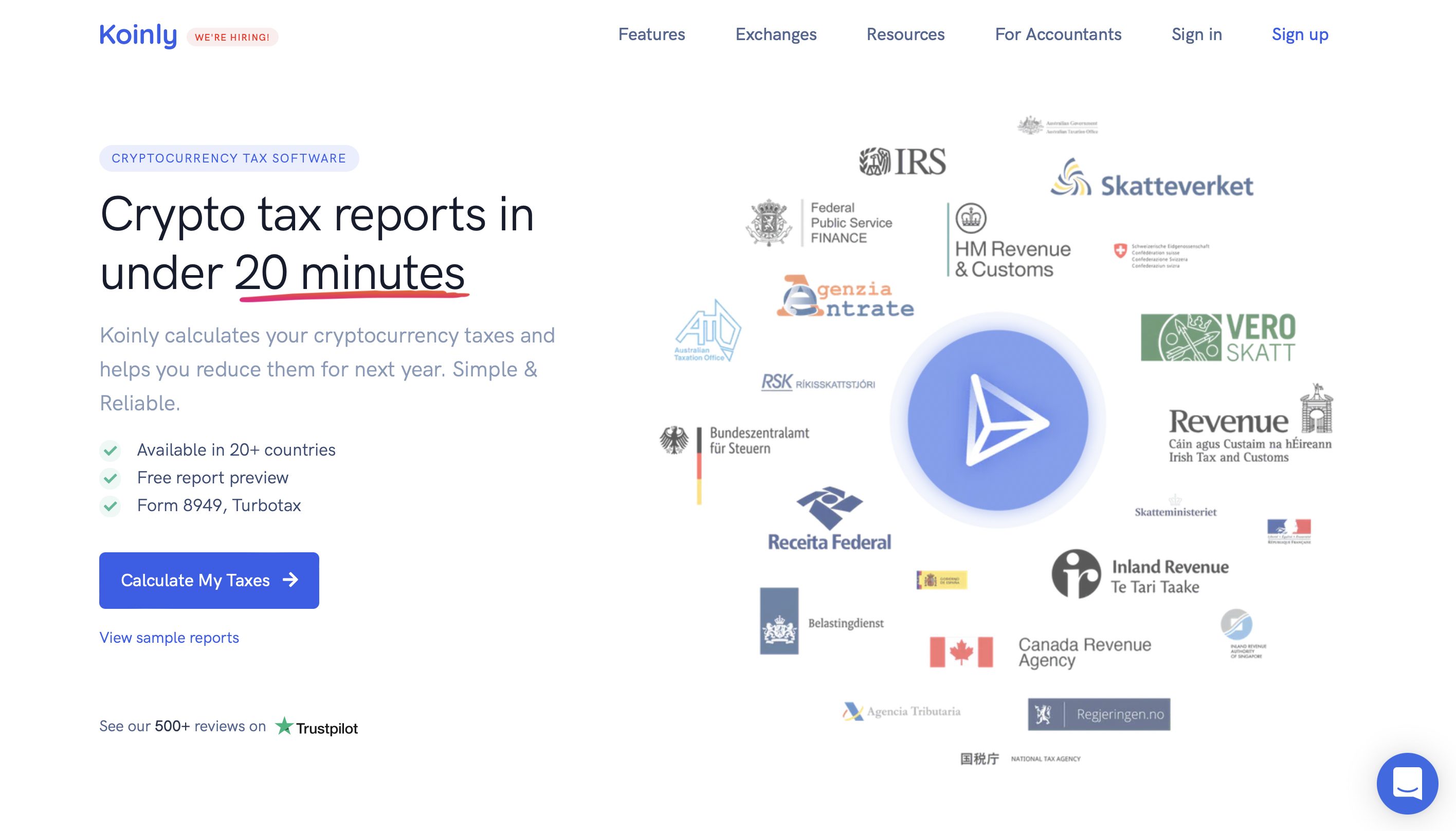

There are plenty of crypto gains calculators available on the market. Using a tax calculator. Koinly is a popular platform with a crypto tax calculator available in over 20 countries including the UK.

As with any investment it is subject to tax rules. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270. Capital GainCapital Loss Gross Proceeds - Cost Basis.

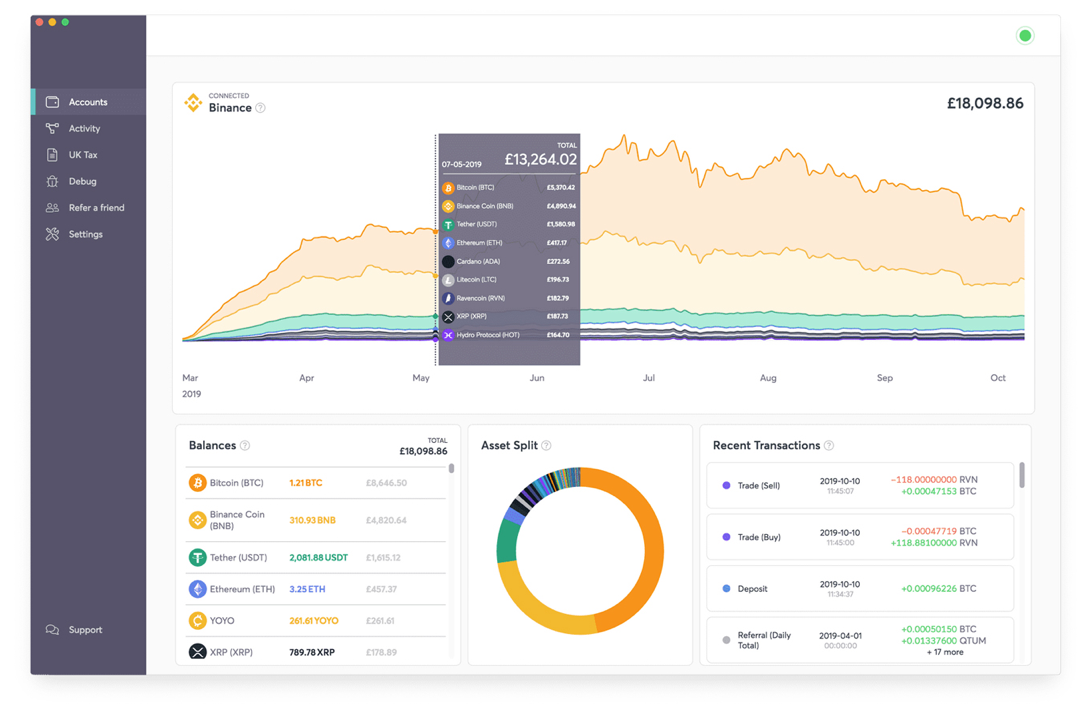

Our free tool calculates your capital gains through the following formula. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Guides and tips to assist with the generation and submission of reports.

This list is compiled out of the best available. Not sure the tax implications of making money from crypto. 12570 Personal Income Tax Allowance.

Research suggests that almost a quarter live in the capital with 12 living in Englands North West and 11 in both the South of England. Heres a one-stop-shop for everything UK crypto tax. Best Crypto Tax Calculators in the UK.

Written by Patrick McGimpsey David Melbourne Layla Huang and 1 other. Think crypto tax calculators how to guides tax tips. How is crypto tax calculated in Australia.

It is the individuals responsibility to calculate any gains or losses through buying and selling cryptoassets for personal investment. Create your free account now. Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically.

Once youve entered your capital gains and losses well. Crypto tax breaks. 20 28 for residential property for your entire capital gain if your overall.

For example if you buy 1 BTC at 1000 and a second BTC for 3000 your average cost would be. Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts. 17 articles in this collection.

UK crypto investors can pay less tax on crypto by making the most of tax breaks. It takes less than a minute to sign up.

11 Best Crypto Tax Calculators To Check Out

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

Best Bitcoin Tax Calculator In The Uk 2021

How To Calculate Capital Gains Tax On Crypto And When Does It Apply Techsling Weblog

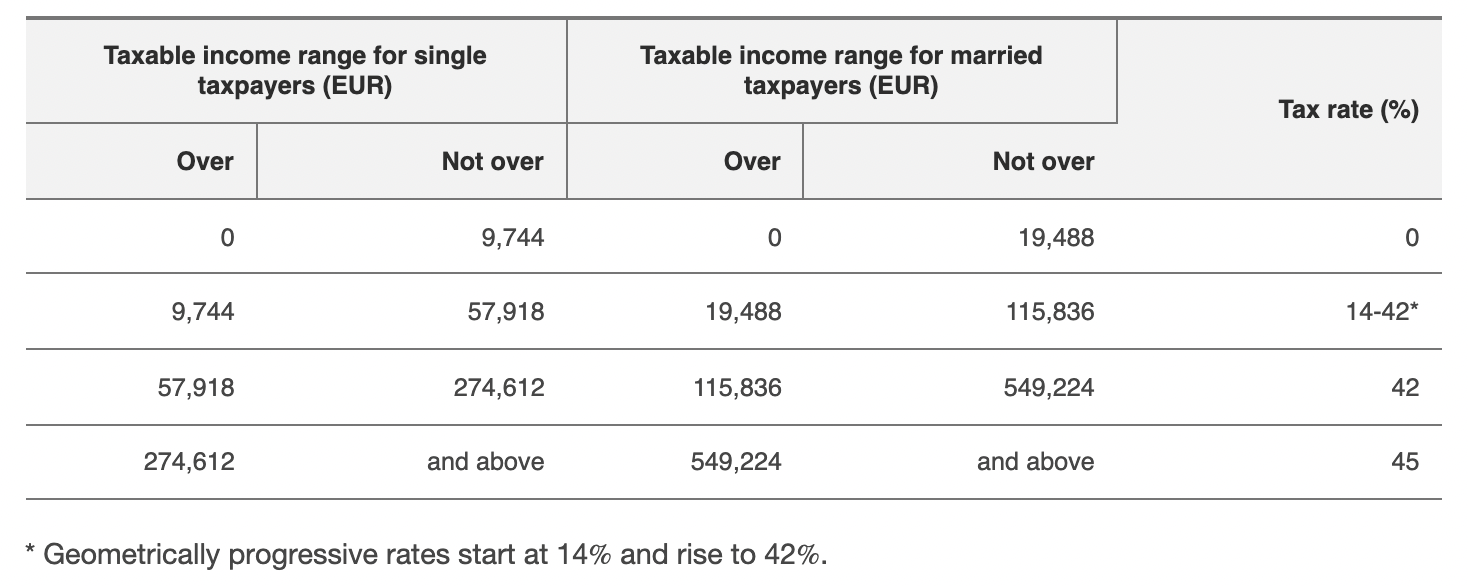

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Crypto Tax Calculation Via Google Sheets Fifo Abc By Ha Duong Token Economy

Best Bitcoin Tax Calculator In The Uk 2021

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

Best Uk Crypto Tax Software Full Review Of The Top 4 Uk Crypto Tax Calculators Youtube

Understanding Crypto Taxes Coinbase

10 Best Crypto Tax Software In 2022 Top Selective Only

Uk Resident Find Out If You Owe Tax On Crypto

Income Tax Github Topics Github